What Are the Jack in the Box Franchise Requirements?

Are you interested in learning more about the Jack in the Box franchise requirements?

Are you searching for the most recent Jack in the Box Franchise EBITDA based on our historical average?

At Jack in the Box, this is a common question we receive from those interested in franchising with us.

In this article, we will go over the Jack in the Box EBITDA from our latest Franchise Disclosure Document.

EBITDA stands for “earnings before interest, taxes, depreciation, and amortization.” These margin percentages reflect the short-term operational efficiency of the franchise.

This is a number you’ll find useful when comparing franchise opportunities with different capital investment requirements, fees, etc.

A similar term you should be aware of is EBITDAR which excludes rent from the equation. You’ll notice this percentage is typically much higher than EBITDA.

The EBITDA for Jack in the Box is 14% as outlined in Item 19 or our Franchise Disclosure Document.

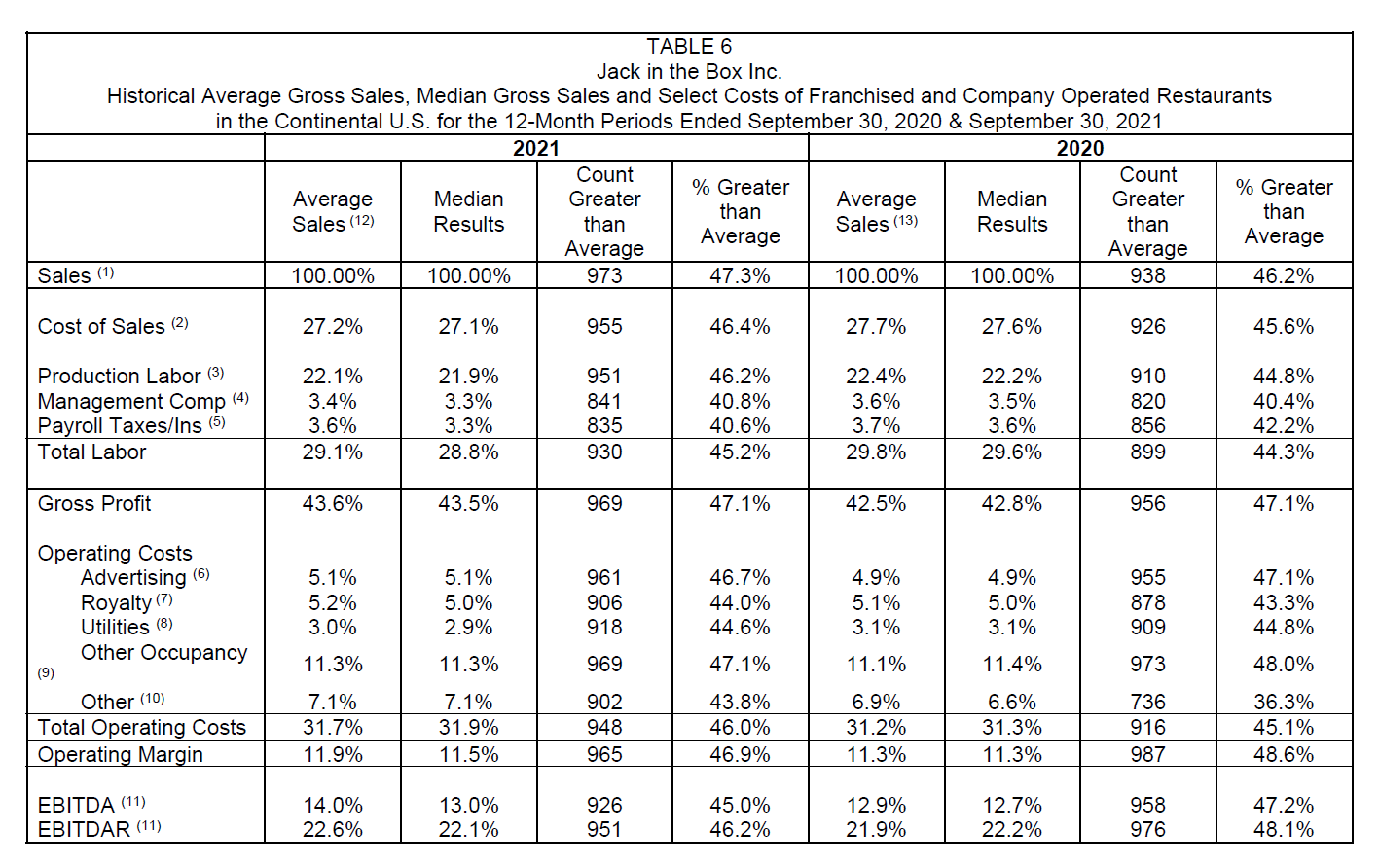

This percentage comes from Table 6 and includes historical gross sales at franchised and company operated restaurants in the continental USA for the 12-month period between September 30,2020 and September 30,2021.

The term “EBITDA” represents operating margin excluding depreciation and amortization. Due to rounding, the subtotals may not total exactly.

Please note, your individual results may differ. There is no assurance you will earn as much.

In Table 6, you can also find both of the fees associated with Jack in the Box. These fees are labeled as Advertising and Royalty under Operating Costs.

Like most franchises, you’ll notice Jack in the Box has ongoing royalty fees. Our royalties at Jack in the Box are:

These royalties ensure you have the best possible resources to run your business and bring customers to your location.

The estimated initial investment for a Jack in the Box Franchise is $1,697,000 - $2,694,600 excluding land, financing, and certain other costs. We provide a breakdown of this number in our Item 7 found in our Franchise Disclosure Document.

Your initial investment includes virtually everything it takes to start a new restaurant:

These initial investment figures are based on Company-developed restaurant costs to open MK9 and MK10 prototypical buildings in fiscal years 2017 to 2019.

The cost of land will vary widely, depending upon size and location of the property and whether you purchase/own the land or enter into a lease arrangement.

Due to the cost of opening a restaurant with Jack in the Box, we have three minimum financial requirements all our potential franchisees must meet.

If you’re unable to meet these requirements, there are many potential sources of liquidity that may be overlooked. For example:

These are just a few of the options you may like to consider to meet our financial requirements.

In addition to the financial requirements above, we also require that potential franchisees have 5+ years in restaurant operation or commit to bringing on someone with that experience.

We hope this article gave you a better understanding of the Jack in the Box Franchise EBITDA.

At Jack in the Box, we work with our franchisees every step of the way in order to get their restaurants up and running.

Here are some additional online resources you may like to check out:

If you have any questions, please contact our franchise sales and support team.

Are you interested in learning more about the Jack in the Box franchise requirements?

Are you interested in learning exactly how much a Jack in the Box Franchise makes per year?

Are you searching for information on the average unit volume (AUV) of Jack in the Box?